Introduction

Hearth Tax

Window Tax

Servants' Tax

Shop Tax

Further reading

Introduction

Historical tax rolls from the 17th to the early 19th centuries are now available to search and view for free on Scotland’s People. You can download and save them for a small fee. You can also use the servant tax rolls (male and female) search to look for individuals by name and pay a small fee to save and download the images. The records will be of particular interest to economic, family, local and social historians and researchers, providing a snapshot into people’s lives.

The records of 15 different types of taxation list a large variety of people, from cottars to Dukes in each of Scotland's parishes and burghs. These include taxes on hearths (or fireplaces), windows, servants, carts and carriages and horses and dogs.

The tax rolls date from the last decade of the 17th century, during the reign of William and Mary; a time of foreign wars, economic troubles, famine and poor weather. They reveal the extraordinary range of people who were liable to pay tax imposed to meet the cost of foreign wars and the defence of the Kingdom.

In this feature, we highlight four different taxes on hearths, windows, servants and shops, and explore what they were and what we can learn from them.

Hearth Tax

The Hearth Tax rolls, 1691-1695, list everyone in Scotland who paid a one-off tax of 14 shillings on every hearth (or fireplace), including kilns, in order to raise money for the Army. This was payable at Candlemas on 2nd February 1691. Only the poor and hospitals were exempt.

They reveal the names of people and their wealth by listing the size of each building, place, estate and parish in the late 17th century. They provide the first comprehensive survey of all towns, villages and other inhabited places in Scotland, showing household structures, living conditions and who lived where at this time.

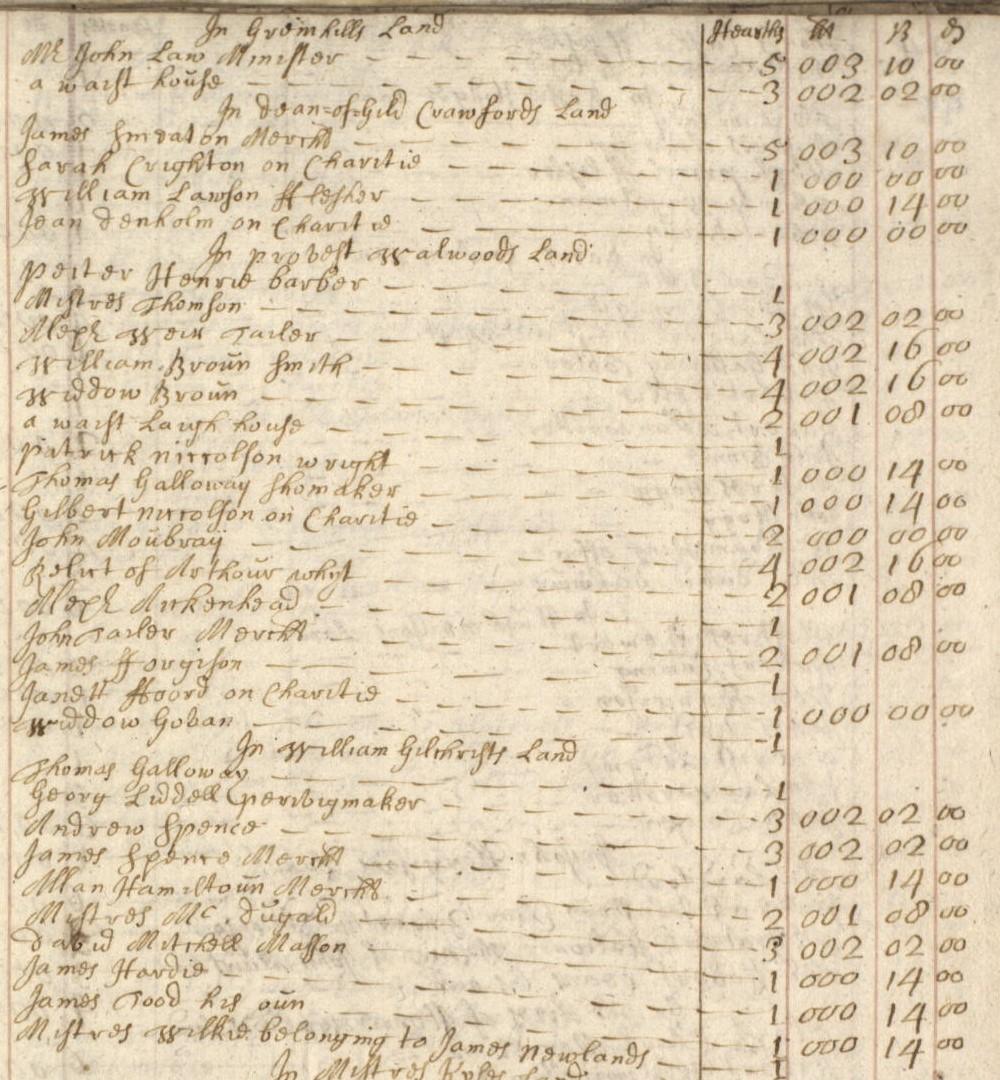

An extract from the Hearth Tax rolls for Edinburgh shows the number of people with different occupations living in proximity to one another in the Old Town of Edinburgh. In Provost Walwoods Land, there are 15 people listed, including a barber, tailor, smith, wright, shoemaker, merchant and two individuals reliant on charity. For William Gilchrist’s Land, there are ten people listed, including two merchants and a ‘perivigmaker’ (a wig-maker).

Crown copyright, National Records of Scotland (NRS), E69/16/2, page 97

You can view the full entry and transcription for NRS, E69/16/2, page 97, using the tax rolls search on Virtual Volumes. Please note that you will need to be logged in to view this.

The Hearth Tax rolls also show that there were huge difficulties in collecting the tax, particularly in the Highlands; attempts continued until 1695 in some regions of Scotland. There are no records for Orkney, Shetland, Caithness, Ross and Cromarty.

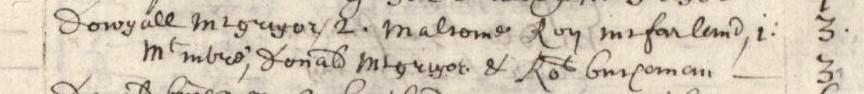

Within the Hearth Tax rolls for Inshalloch (Inchcailloch) parish in Buchanan, Stirlingshire in 1694, there is a reference to Donald McGregor. He may have been the father of Rob Roy MacGregor (1671-1734), an outlaw and folk hero, and well-known figure in Highland Romanticism.

Crown copyright, NRS, E69/22/1, page 13

Transcription of Donald Mcgregor's entry in the Hearth Tax roll for Inshalloch parish, 1694

Dowgall Mcgregor 2, Malcome Roy mcfarlane i 3

Mcinbrie, Donald Mcgregor & Ro[ber]t Buchanan 3

We know from the Old Parish Register (OPR) for Buchanan that a Robert McGregor was baptised on 7th March 1671, the son of Donald McGregor of Glengyle and Margaret Campbell. The entry also includes the names of two witnesses: W[illia]m Andersone min[iste]r and Johne mcgregore.

Crown copyright, NRS, OPR 474/1, page 26

The Hearth Tax roll for Inshalloch provides little information about the individuals in the parish. However, it does list the heads of families and the size of households, which are smaller than those in Edinburgh city. Hearth Tax rolls are a valuable resource for researching rural and Highland areas in Scotland and help augment surviving church registers.

In the late 18th century, the government of William Pitt the Younger introduced many individual taxes, including duties on houses, windows, servants, carriages and carts, horses and dogs, and even clocks and watches. These were all taxes on householders, but in practice only the wealthy were taxed.

Window Tax

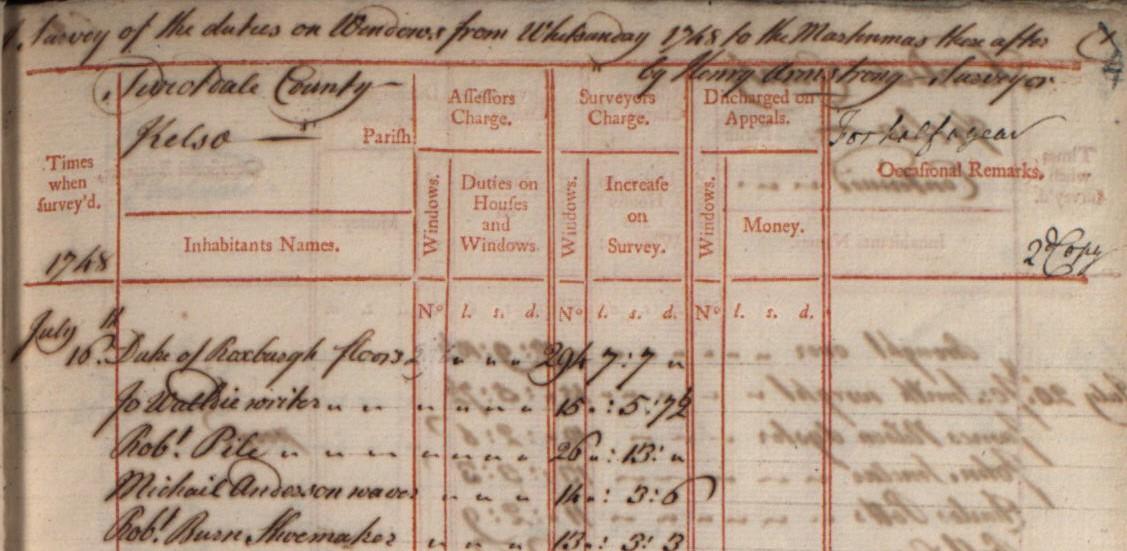

From 1748 until 1851, taxes were levied on the occupants of buildings with several windows in burghs and county parishes in Scotland. Only those with more financial means were taxed, so the usefulness of these records for research is limited. You may also find in some rural areas that the only people liable for tax were the minister and lairds.

When the tax was first introduced, only those with ten or more windows were liable to pay the duty, on a sliding scale from six pence to one shilling per window. From 1766, they list those with seven or more windows, on a scale from two pence per window, to two shillings per window, if you had 25 or more.

Near the top of the range of homes taxed was the Duke of Roxburghe's Floors Castle near Kelso. The castle had 294 windows which cost him seven pounds and seven shillings in 1748. According to The National Archives currency converter, this was equivalent to around £857.52 in 2017. The Bank of England's inflation calculator estimates the cost at £1,330.35 as of May 2025.

Crown copyright, NRS, E326/1/111, page 4

The Window Tax was long seen as the reason for the number of windows apparently blocked up in buildings dating from the 18th century. However, this is likely to be more myth than fact. Blocking up a window would only have saved a few shillings per year, and is unlikely to have been sufficient incentive for the well-off to give up their daylight. Many windows in Edinburgh's New Town appear to have been blocked, but were in fact designed for architectural symmetry. Whatever the reason, there are examples of some windows being blocked up as with this tax roll for Dumfriesshire.

Crown copyright, NRS, E326/1/32, page 73

Transcription of three entries from the Dumfriesshire Window Tax which shows some windows blocked up since the last survey, 1754

1753

December 26 W[illia]m Irvin Gribton 25 windows £01.12.6

1 closed since last survey

1753

Dec[ember] 10 Mr William Kay Crawfordton 12 windows £0.3.0

3 closed since last survey

1753

14th November Murdo Murphie Minshive 9 windows £0.0.0

5 closed since last survey

You can view the full entry and transcription for NRS, E326/1/32, page 73, using the tax rolls search on Virtual Volumes. Please note that you will need to be logged in to view this.

By the time the Window Tax was abolished in 1851, it was referred to by Victorian health campaigners as a "tax on light and air". The idiom "daylight robbery " is often linked to the Window Tax, though there appears to be no scholarly evidence for this.

Servants' Tax

The Servants' Tax was levied on households employing ‘non-essential’ female/male servants. This was primarily aimed at domestic/personal servants in the town and country and excluded the majority of the servant class, such as farm labourers and people working in factories, inns and shops.

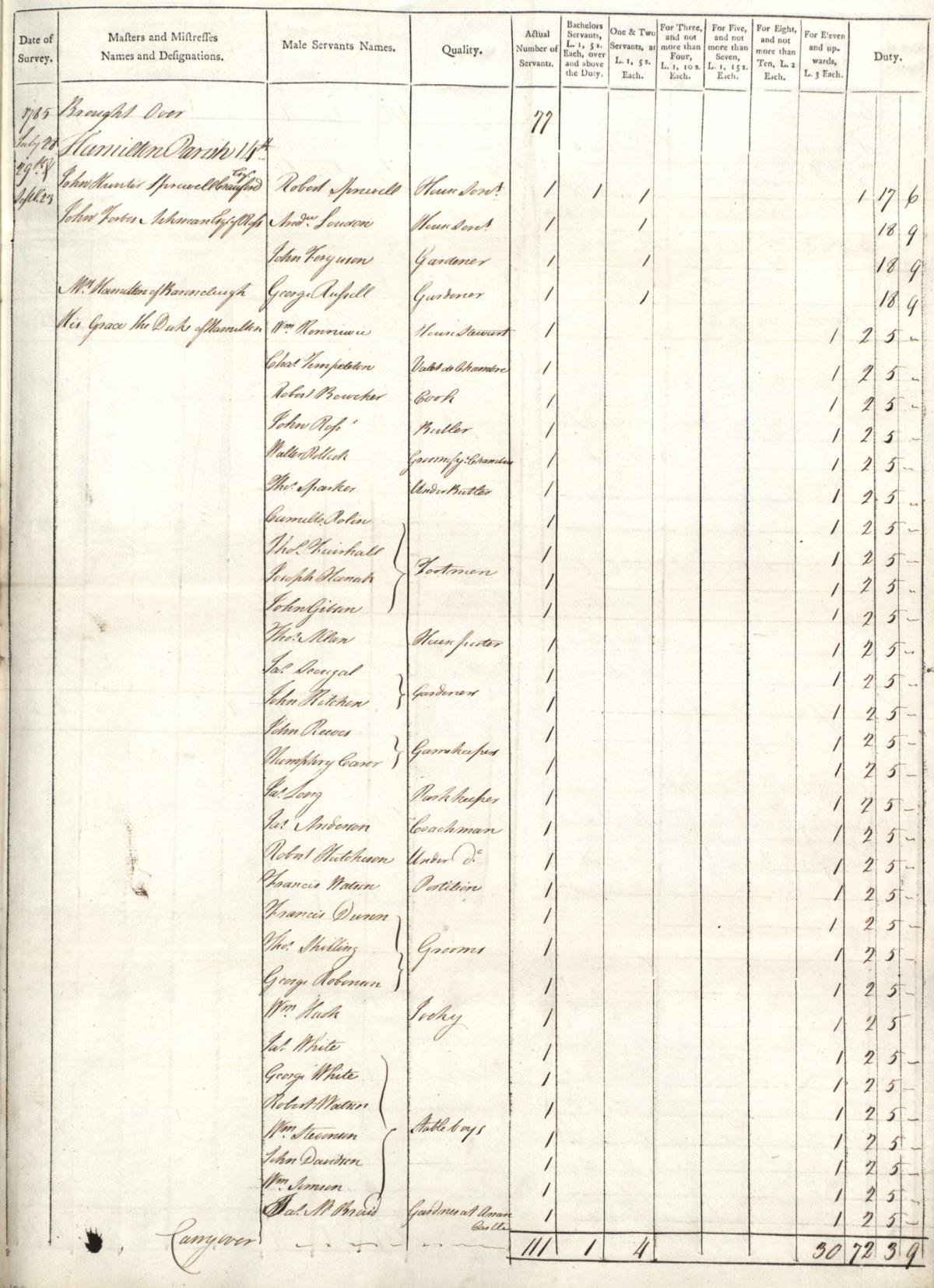

The tax was targeted at wealthy households which employed domestic and personal servants such as butlers, valets, coachmen and gardeners. In Scotland, taxes on female servants were assessed between 1785 and 1792 and on male servants between 1777 and 1798. The tax rolls give the location, name of the master or mistress (the person in charge of the household) and usually the name of the servant.

The Duke of Hamilton employed a huge retinue of 41 servants at Hamilton Palace in Lanarkshire in 1785. This extract from the Male Servants Tax roll shows the range of their occupations, including a ‘Valet de Chambre’, cook, butler, four footmen, two gardeners, two gamekeepers, three grooms and five stable boys.

Crown copyright, NRS, E326/5/5, page 129

You can view the full entry and transcription for NRS, E326/5/5, page 129, using the tax rolls search on Virtual Volumes. Please note that you will need to be logged in to view this.

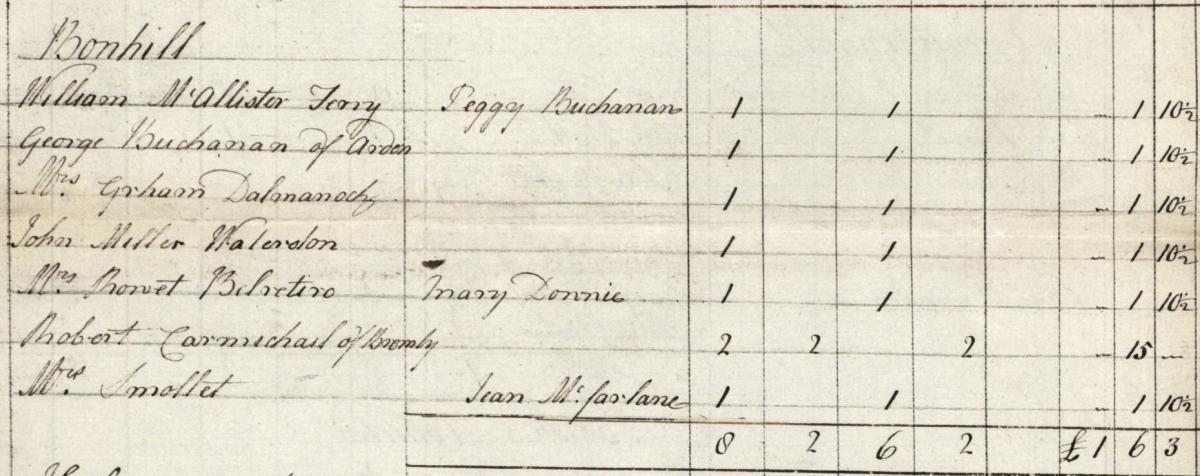

The tax was not just the preserve of the ultra-rich, but included those who were well-off with more modest means. Mrs Smollet of Bonhill (the sister of Tobias Smollett, writer and surgeon), employed a total of three servants in 1785: a postilion, a gardener and a female servant whose designation is not given.

Crown copyright, NRS, E326/5/5, page 49

You can view the full entry and transcription for NRS, E326/5/5, page 49, using the tax rolls search on Virtual Volumes. Please note that you will need to be logged in to view this.

Crown copyright, NRS, E326/6/1, page 73

You can view the full entry and transcription for NRS, E326/6/1, page 73, using the tax rolls search on Virtual Volumes. Please note that you will need to be logged in to view this.

Shop Tax

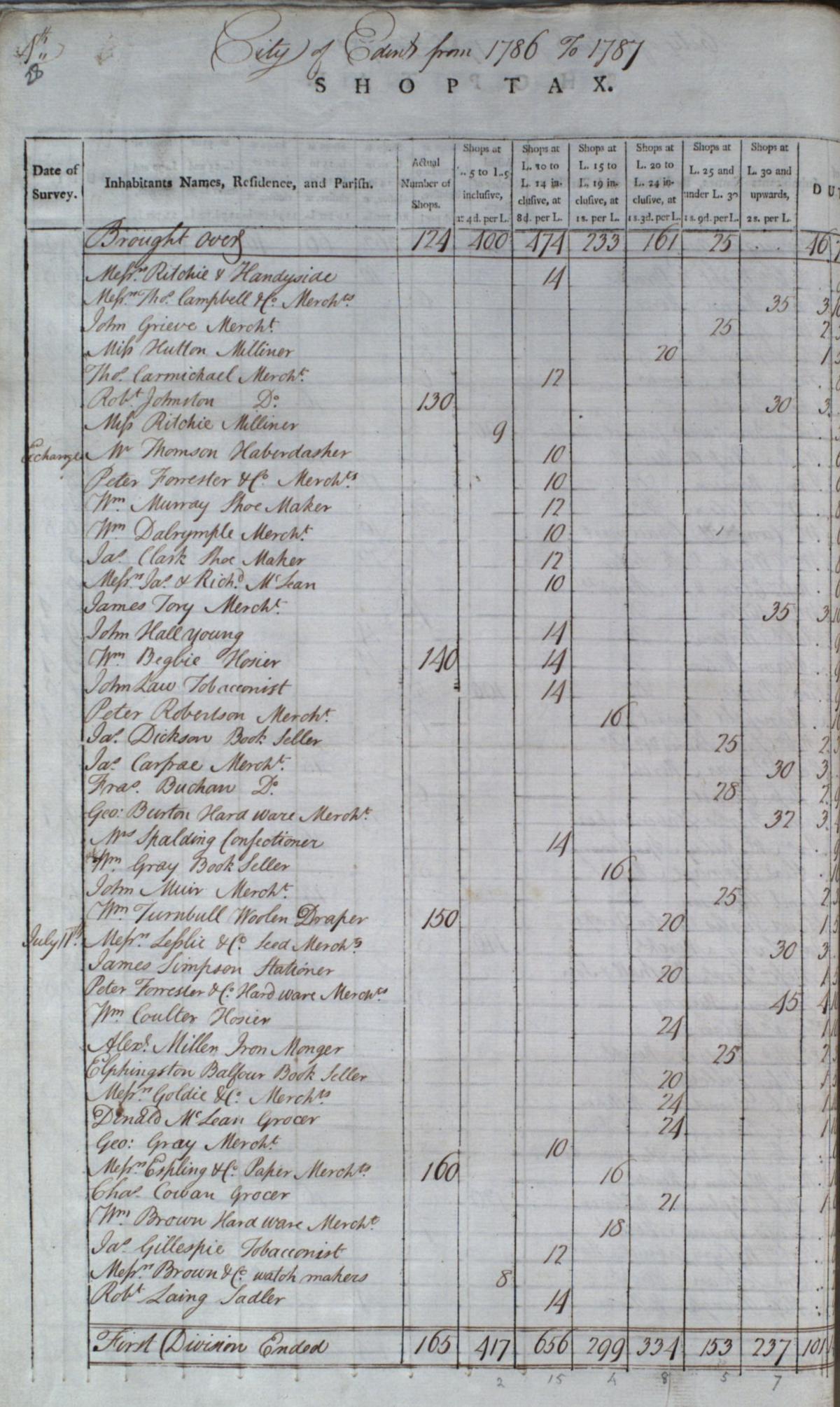

The Shop Tax rolls, 1785-1789, list the names of shopkeepers throughout Scotland in the late 18th century. The names and descriptions of the buildings are often included, as well as the annual rental value of the shops with rent over five pounds.

The Shop Tax was only collected for a few years and there are gaps in the records: they are not complete for all counties, although most of the burghs are covered.

The tax was abolished in 1789 following riots in London.

Crown copyright, NRS, E326/4/4, page 28

An extract from the Shop Tax roll for Edinburgh Burgh shows the variety of shops, with a rental value of over five pounds, which were liable for this tax. These include: booksellers, a confectioner, grocer, hosier, haberdasher, ironmonger, milliner, paper merchant, sadler, seed merchant, shoemaker, stationer, tobacconist, watchmakers and a woollen draper.

Messrs Brown & Co[mpany], Watch Makers, had a rental value of eight pounds and paid the lowest tax of two shillings and eight pence. According to The National Archives Currency Converter, this was worth approximately £10.23 in 2017. Peter Forrester & Co[mpany], Hard Ware Merch[an]t, had an annual rental value of 45 pounds and paid the highest tax of four pounds and ten shillings. This was worth approximately £345.42 in 2017. The Bank of England's inflation calculator estimates the cost at £544.27 as of May 2025.

Mrs Spalding’s shop, a confectioner, had an annual rental value of 14 pounds. She paid nine shillings and four pence in tax. This was worth approximately £35.82 in 2017.

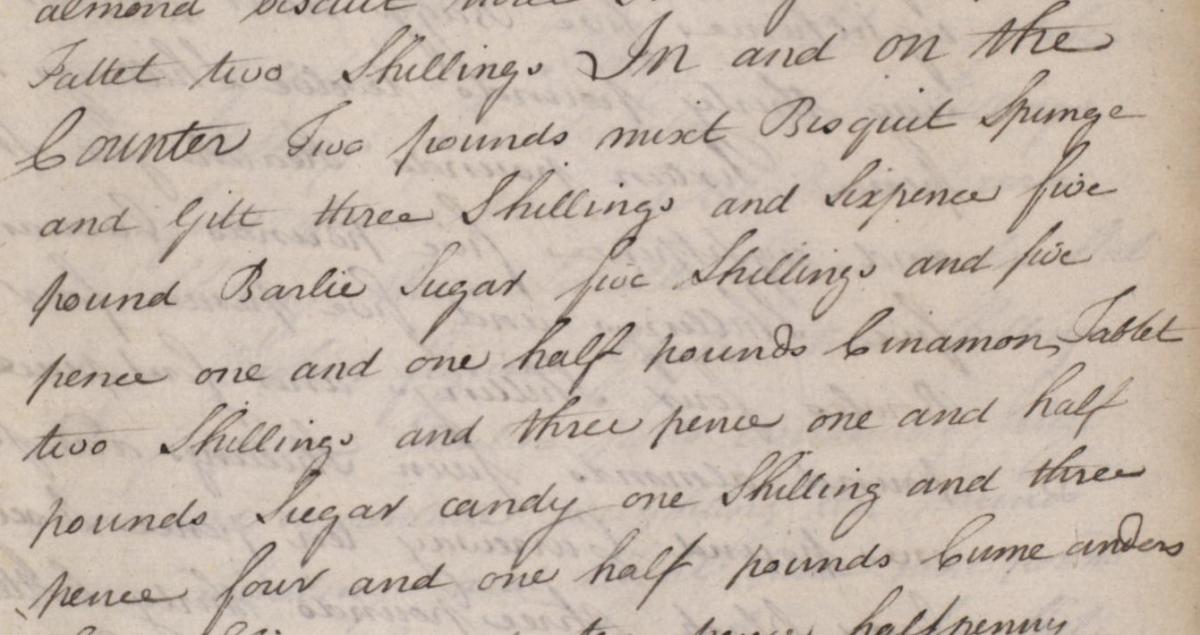

Within the wills and testaments on Scotland’s People, is the testament dative of Charles Spalding, (NRS, CC8/8/126, pages 358-370). He died near Dublin on 2nd June 1783. Because he died without making a will, his widow, Susan Small, was appointed the executrix. His testament is very detailed and includes an inventory of all of his stock in his confectionary shop:

Crown copyright, NRS, CC8/8/126, page 363

Transcription of extract from Charles Spalding's will, 20th August 1783

'…In and on the

Counter Two pounds mixt Bisquit Spunge

and Gilt three Shillings and Sixpence five

pound Barlie Sugar five Shillings and five

pence one and one half pounds Cinamon Tablet

two Shillings and three pence one and half

pounds Sugar candy one shilling and three

pence four and one half pounds Curreanders'

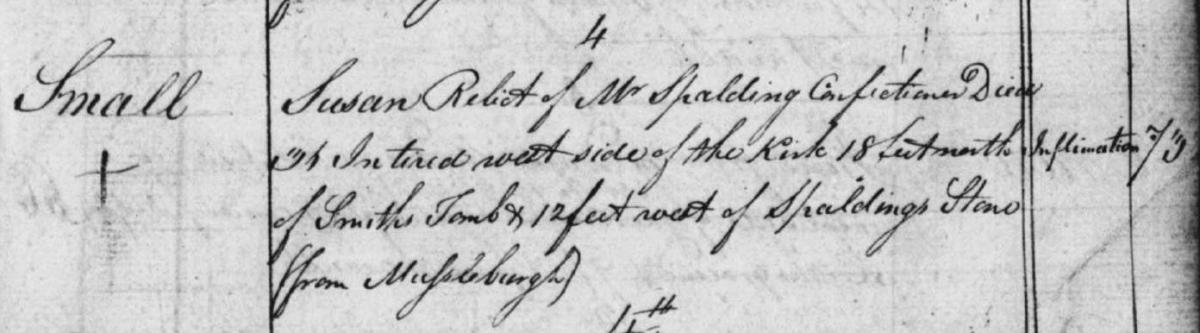

Susan Small died on 31st October 1818 and was buried on 4th November, in Edinburgh. Her entry in the Old Parish Register of Deaths for Edinburgh refers to her as the ‘Relict of Mr Spalding Confectioner’.

Crown copyright, NRS, OPR685/3, page 229

Transcription of Susan Small' s death and burial entry, 31st October 1818

Susan Relict of Mr Spalding Confectioner Died

31 Intired west side of the Kirk 18 feet north Inflimation (Cause of death: inflamation)

of Smiths Tomb & 12 feet west of Spaldings Stone

(from Musselburgh)

The historical tax rolls are now available to search and view for free in the Virtual Volumes search on Scotland’s People. Additionally, the male and female servant tax rolls have been indexed. You can use the servant tax rolls (male and female) search to look for individuals by name and pay a small fee to save and download the images.

Further reading

If you are new to reading and interpreting historical tax rolls, you can find help in our guide to reading older handwriting, the Scottish Handwriting resource and a glossary of abbreviations, words and phrases.

For more information about the historical tax rolls please read our tax rolls record guide. Additional background information can be found in the NRS research guide to Scottish Taxation Records.